MACD+RSI+HTT

What is the Moving Average Convergence Divergence (MACD)?

The Moving Average Convergence Divergence (MACD) is a trend-following momentum indicator that shows the relationship between two moving averages of a security's price. The MACD is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA, resulting in the MACD line. A 9-day EMA of the MACD, called the "signal line," is then plotted on top of the MACD line, which can function as a trigger for buy and sell signals.

What is the RSI Indicator ?

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. Developed by J. Welles Wilder Jr., the RSI oscillates between zero and 100. Traditionally, and according to Wilder, RSI is considered overbought when above 70 and oversold when below 30.

What is High Timeframe Trend ?

The High Timeframe Trend (HTT) is a concept in technical analysis that refers to the overall direction of the market when viewed through the lens of a longer time frame. Unlike short-term trends that might last for days or weeks, high timeframe trends encompass broader movements in the market that can persist for months or even years. Identifying the HTT is crucial for traders and investors as it helps them align their strategies with the prevailing market direction, potentially increasing their chances of success.

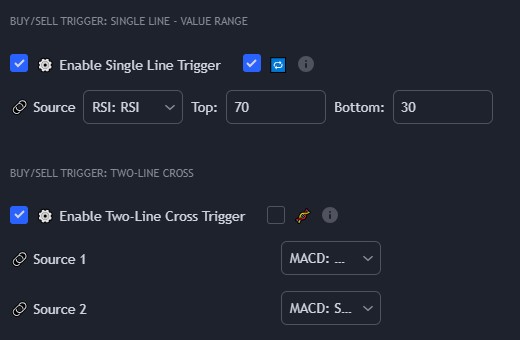

SET SOURCES & RANGES

RSI : Use top and bottom levels according to criteria.

RSI : Use 🔁 tick for using state signals.

Select Source 1 : MACD: MACD

Select Source 2 : MACD: SIGNAL

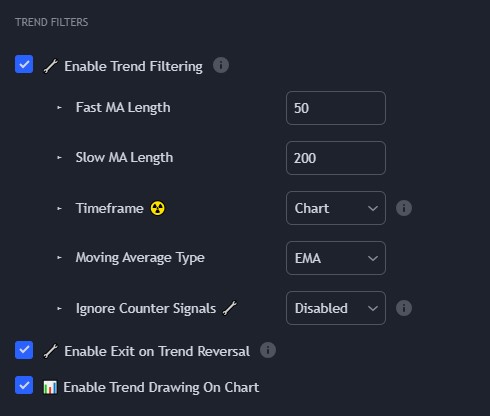

Activate Trend Filter

RESULT

Example Backtest Chart